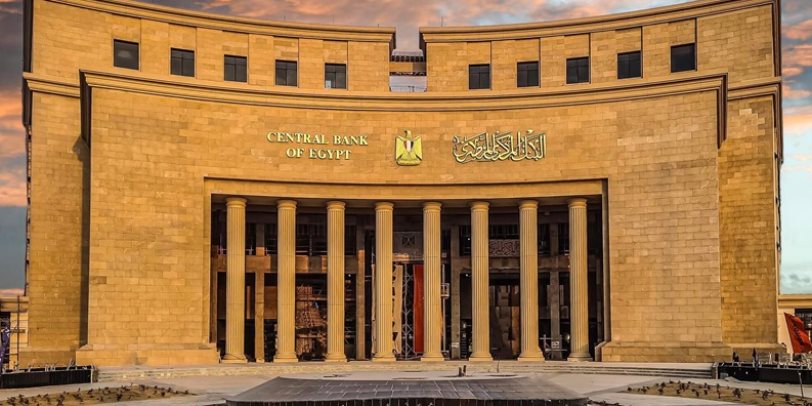

Central Bank of Egypt to Issue Treasury Bills Worth 70 Billion EGP to Finance Budget Gap

Central Bank of Egypt announces 70 billion EGP treasury bills offering to finance budget deficit.

The Central Bank of Egypt (CBE) is set to offer treasury bills worth 70 billion Egyptian pounds tomorrow, Sunday, in durations of 91 and 273 days, in coordination with the Ministry of Finance to finance the budget deficit.

CBE's Treasury Bill Offerings

According to the Central Bank's website, the first offering amounts to approximately 40 billion Egyptian pounds for a duration of 91 days, while the second offering is valued at 30 billion Egyptian pounds for a duration of 273 days.

Throughout the fiscal year, the Ministry of Finance authorizes the Central Bank to manage its special offerings of treasury bills and bonds in Egyptian pounds, with the proceeds funding and disbursing items in the general state budget for the current fiscal year.

Interest Rates

During its extraordinary meeting on March 6, the Monetary Policy Committee decided to raise the deposit and lending rates for overnight transactions and the main operation rate of the Central Bank by 600 basis points to reach 27.25%, 28.25%, and 27.75%, respectively. Additionally, the credit and discount rate was raised by 600 basis points to reach 27.75%.