Egypt’s PMI drops to 48.9 despite record high confidence in non-oil sector

Increased confidence can be attributed to Egypt's vaccination rate and lowered restrictions on global travel measures that will support tourism activity

Egypt’s non-petroleum sector continues to contract, now for the 10th month in a row, despite increased optimism by companies towards future business activity in in September.

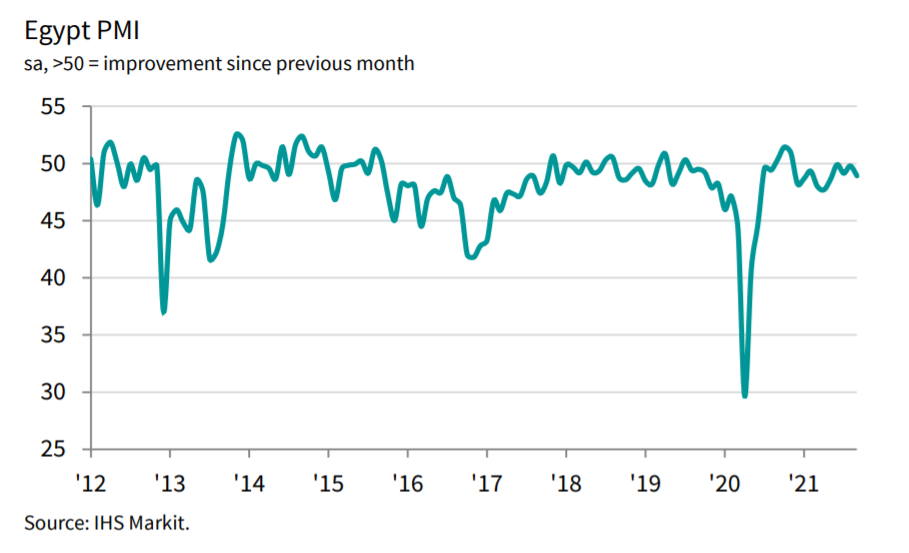

Egypt’s Purchasing Managers’ Index (PMI) recorded 48.9 in September, recording its lowest in four months, down from 49.8 in August, which was just shy of meeting its highest rating this year.

The index measures PMI ratings under the 50.0 neutral mark as an indication of contraction.

IHS Markit noted in their report that companies also reported a slight decline in new orders received during the month, which was linked to a fall in client demand and weak economic conditions.

“While the latest PMI data pointed to non-oil output and new orders declining at the end of the third quarter, these reductions were only slight, while the two indices remained above their long-run averages for the fifth month in a row,” explained David Owen, Economist at IHS Markit.

Egyptian companies are more confident that activity will improve over the next year, with around 71% of those surveyed giving a positive forecast, climbing to its highest rating recorded since the beginning of the series in April 2021.

According to IHS Markit, increased confidence can be attributed to a boost to Egypt's vaccination rate and lowered restrictions on global travel measures that will support tourism activity.

“… confidence towards future activity soared to a record high in the series nine-year history. The rise coincided with a faster vaccination program in Egypt and a further relaxation of travel measures that should aid tourism income in the fourth quarter” added Owen.

The report explained that with optimism rising, so did company employment numbers, which grew for the 3rd successive month in September, however job creation rates remained mild as staff replacement continues to be difficult. Additionally, companies largely found that current capacity was sufficient to meet new orders, with backlogs rising only slightly from August.

Egyptian non-oil companies had to deplete inventories of purchases in September, with several companies pointing to difficulties buying new inputs due to global shortages.

Although purchasing activity climbed in September, in efforts to balance overall stocks, this was slower than recorded in August.

"While there was also further supply risk from lower inventory levels and raw material shortages, a record improvement in vendor performance suggests that firms may start to see procurement issues ease" explained Owen.

Raw material prices faced by Egyptian firms were on the up again in September, with purchase cost inflation accelerating to the fastest in just under three years. Companies also saw a renewed increase in staff costs, leading to an even sharper uptick in overall price pressures than in August.