Goldman Sachs expects CBE to reduce interest rates by 1% next September

The report anticipates a decrease in interest rates for Egypt's IMF program due to inflation projections.

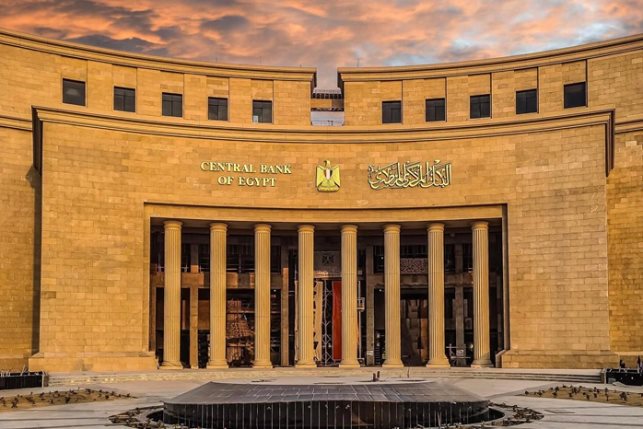

The Central Bank of Egypt (CBE) is expected to reduce interest rates by 1% next September, followed by a decrease of 2% in the last quarter of 2024, according to a report released by the American investment bank Goldman Sachs.

The Goldman Sachs bank indicated that Egypt's interest rate will witness a cumulative reduction of about 11.25% in 2025, ending with 13%, compared to its previous estimate of 9%.

The bank expected inflation to decline by 12.5% during 2025, which is less than analysts’ consensus expectations of 16%, and to fall below 10% by the end of the year.

Egypt's exchange rate will not witness turmoil during the coming period, the report added.

The report anticipates a decrease in interest rates for Egypt's IMF program due to inflation projections.

It suggests that inflation is expected to reach 29% by the year-end, while consensus estimates predict a decline to 23%. This indicates the potential for a reduction in interest rates.

Earlier in July, the CBE’s Monetary Policy Committee agreed to maintain current key interest rates, noting “the current monetary stance is appropriate to support the sustained moderation of inflation”.

The overnight deposit rate remained at 27.25%, the overnight lending rate at 28.25%, and the rate of the main operation at 27.75%. The discount rate was held steady at 27.75%.