CBE indefinitely suspends fees on e-banking transactions in EGP

Launched in 2022, the Instant Payment Network (IPN) – not to be confused with the InstaPay app – is a national network linking all operating banks within Egypt, facilitating the instantaneous execution of all banking transfer services 24/7

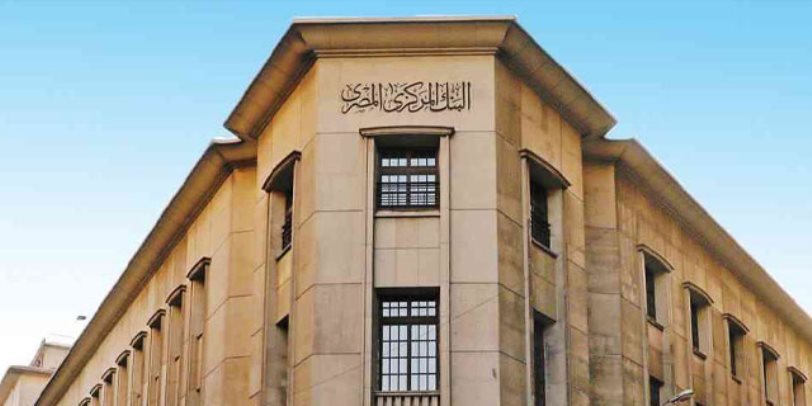

The Central Bank of Egypt (CBE) decided to indefinitely postpone implementing fees related to bank transfer services executed via electronic channels - internet banking and mobile banking applications - in Egyptian pounds across its Instant Payment Network and the CBE’s InstaPay application.

These decrees are within the framework of CBE's strategy to encourage individuals to embrace digital financial services and leverage its wide range of benefits. It also aligns with the broader goal of promoting digital transformation and financial inclusion, offering individuals the convenience of accessing banking services anytime and from anywhere.

Launched in 2022, the Instant Payment Network (IPN) – not to be confused with the InstaPay app – is a national network linking all operating banks within Egypt, facilitating the instantaneous execution of all banking transfer services 24/7.

The central bank’s official statement explained that the network is “one of the most significant infrastructure projects for payment systems sponsored by the CBE”.

The network reported significant growth, the CBE noted, revealing that is has helped carry out 404 million transactions worth EGP 815 billion through via InstaPay and other electronic banking channels for over 6.5 million users.

Earlier this year, the CBE had shared that it would impose fees on transactions made via the InstaPay app in early 2024.