Egypt's central bank issues EGP60B in T-bills Thursday

The T-bills were offered in two installments, with the first valued at EGP 35 billion with a 182-day term.

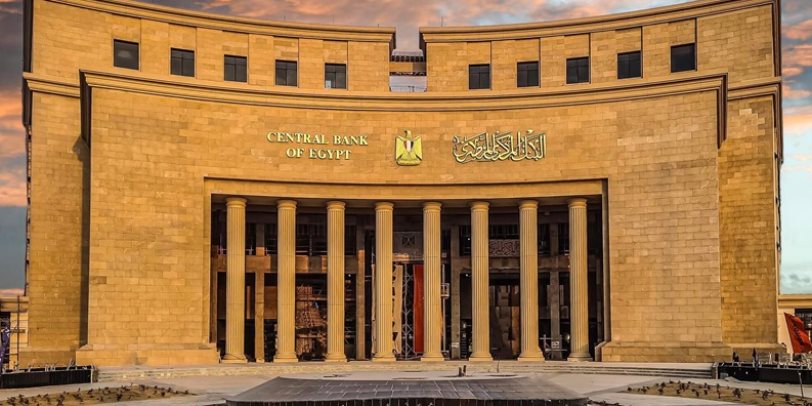

The Central Bank of Egypt (CBE), on behalf of the Ministry of Finance, is set to issue EGP 60 billion in treasury bills (T-bills) on Thursday, November 7.

The T-bills were offered in two installments, with the first valued at EGP 35 billion with a 182-day term, and the second worth EGP 25 billion with a 364-day term.

The Ministry of Finance plans to issue 26 treasury bill and bond auctions worth EGP 542 billion in November. This includes 16 treasury bill auctions totaling EGP 480 billion and 10 bond auctions worth EGP62 billion. These are part of the government's strategy to meet previous debt obligations and finance the state budget deficit.

In November, the Central Bank will conduct four treasury bill auctions totaling EGP 150 billion with a maturity of 91 days, another four auctions with the same amount for 182 days, and four other auctions totaling EGP 90 billion for 273 days, as well as four auctions of the same amount for 364 days.

Additionally, two bond auctions for two-year bonds worth EGP 10 billion are planned, along with two "floating-rate" auctions for three-year bonds totaling EGP 4 billion, and four fixed-rate bond auctions for three years worth EGP 44 billion EGP. There will also be two floating-rate bond auctions for five years worth EGP 4 billion.

Banks operating in the Egyptian market are the largest investors in government treasury bills and bonds, which are regularly issued to cover the state budget deficit.

These bonds and bills are issued through 15 banks participating in the "Primary Dealers" system in the primary market. These banks then resell a portion of the instruments in the secondary market to individual and institutional investors, both local and foreign.