Egypt recorded $9.7B BoP surplus in FY2023/2024, pushed by March reforms | CBE

The overall surplus was largely driven by a substantial performance in the second half of FY2023/2024, where it soared to $10.1 billion, attributed to structural reforms implemented on March 6, 2024, which bolstered investor confidence

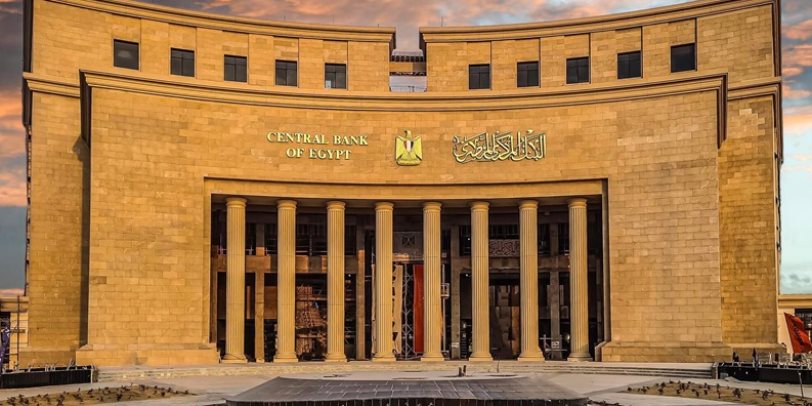

The Egyptian economy reported a significant balance of payments (BoP) surplus of $9.7 billion for the FY2023/2024, according to the latest BoP data released by the Central Bank of Egypt (CBE) on Tuesday.

The overall surplus was largely driven by a substantial performance in the second half of FY2023/2024, where it soared to $10.1 billion, attributed to structural reforms implemented on March 6, 2024, which bolstered investor confidence.

It also significantly improved capital and financial accounts, leading to a net inflow of $29.9 billion, up from $8.9 billion in the previous year, fueled by a record surge in foreign direct investment (FDI) which reached $46.1 billion, with $40.5 billion received in the latter half (H2) of the fiscal year alone.

Egypt’s current account deficit expanded in FY2023/2024, registering at $20.8 billion, a significant increase from $4.7 billion in the previous year, the CBE wrote.

The trade deficit rose by 27%, widening to $39.6 billion from FY2022/2023’s $31.2 billion.

The oil-trade balance reported a deficit of $7.6 billion against a $410 million, the CBE explained.

The non-oil trade deficit also expanded, increasing by $354.8 million to register at $31.9 billion, driven by a rise in non-oil merchandise imports.

Key contributing factors included a considerable drop in oil exports, which plummeted by $8.1 billion to $5.7 billion, alongside a decline in Suez Canal receipts, which fell by 24.3% to $6.6 billion.

The tourism sector provided some relief, with revenues increasing by 5.5% to $14.4 billion, driven by a rise in tourist arrivals and overnight stays.