Sovereign Fund of Egypt expects new industry-focused subfund to launch in July

The SFE is currently discussing with investors in the food, engineering, and building materials industries, as well as industries related to the manufacturing of railway and train supplies

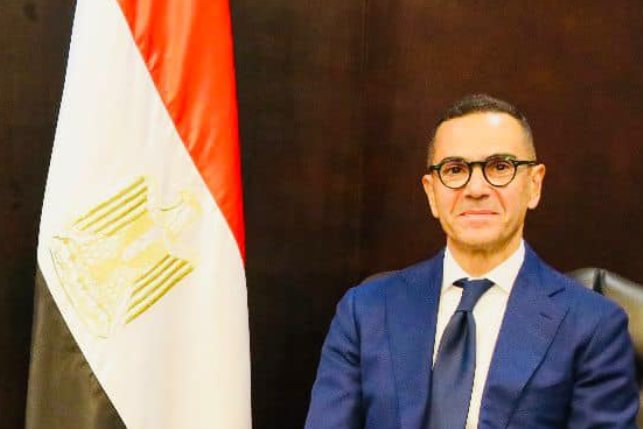

The Sovereign Fund of Egypt (SFE) anticipates that it will be able to launch its new industry-focused subfund in July, revealed SFE head Hala El Said to local media on Wednesday.

According to El Said, the fund is in talks with 7 local investors across a variety of industries to launch the subfund. Talks are expected to wrap up in June.

El Said disclosed the fund was exploring establishing the subfund just last week.

The SFE is currently discussing with investors in the food, engineering, and building materials industries, as well as industries related to the manufacturing of railway and train supplies.

The industry-focused subfund is part of the SFE’s multisector strategy, which spans across 9 sectors; Tourism, Real Estate & Antiquities; Infrastructure & Utilities; Healthcare & Pharma; Financial Services & Fintech; Education; Food and Agriculture; and Telecommunication.

The sovereign fund also launched its Pre-Initial Public Offering (Pre- IPO) Subfund back in 2022 which offers investors the chance to obtain stakes in state-owned enterprises ahead of their IPOs in line with the government’s state ownership policy document and strategy to exit certain sectors.

So far, 5 of these sector-focused subfunds are actively managed by a dedicated board of directors according to their website.

In a bid to encourage fresh investments, Egypt’s sovereign fund is planning a tour of the Gulf next month.

El Said revealed at the time that the tour would include meetings with investors, financial institutions, and other sovereign funds to discuss potential investments on offer.