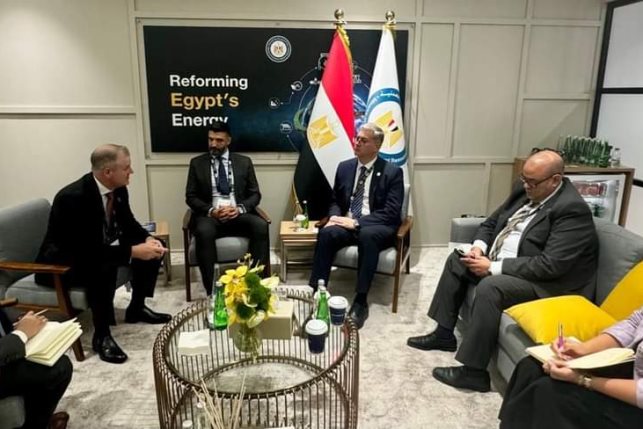

Egyptian Central Bank Deputy Governor Outlines Economic Growth, Employment Goals

Abu El-Naga affirmed the diversified nature of the Egyptian economy, capable of attracting foreign direct investments through upcoming measures.

Rami Abu El-Naga, Deputy Governor of the Egyptian Central Bank, emphasized the government's objectives of fostering economic growth and elevating employment rates during the upcoming phase. He highlighted that annually between 800,000 to one million citizens join the workforce.

Speaking at a press conference, Abu El-Naga affirmed the diversified nature of the Egyptian economy, capable of attracting foreign direct investments through upcoming measures.

The Egyptian Central Bank reiterated its commitment to maintaining price stability over the medium term. In pursuit of this goal, the bank remains dedicated to transitioning towards a flexible framework for inflation targeting.

This strategy involves continuing to target inflation as a nominal anchor of monetary policy while allowing the exchange rate to be determined by market mechanisms.

The unification of the exchange rate is deemed crucial as it contributes to eliminating the accumulation of demand for foreign currency following the closure of the gap between the official and parallel market exchange rates.

During its extraordinary meeting, the Monetary Policy Committee decided to raise the overnight deposit and lending rates, as well as the main operation rate of the Central Bank, by 600 basis points to 27.25%, 28.25%, and 27.75%, respectively. Additionally, the credit and discount rates were raised by the same margin to reach 27.75%.