Egypt's Economic Reform Gains Momentum: Former Official Endorses Interest Rate Hike, Exchange Rate Flexibility

Preparations for implementing the reform program include securing the necessary financing to support foreign currency liquidity.

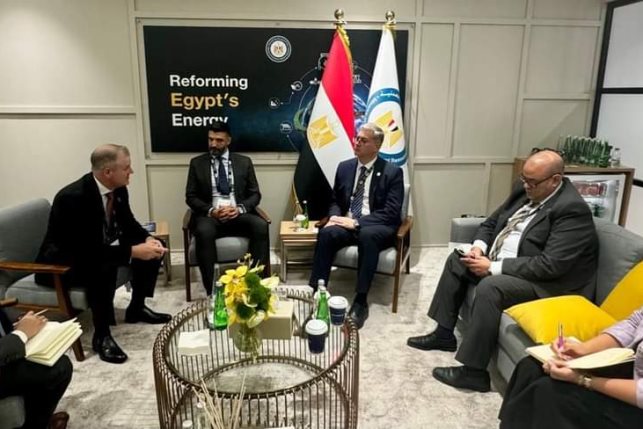

Dr. Khaled Sherif, former Assistant Minister of Communications | File

Dr. Khaled Sherif, former Assistant Minister of Communications | File

Dr. Khaled Sherif, former Assistant Minister of Communications, stated that the recent interest rate hike and adoption of a flexible exchange rate mechanism based on supply and demand dynamics were anticipated and necessary measures for economic reform. He emphasized their role in unifying the exchange rate and curbing inflation, particularly as the black market for the dollar had at times doubled the official market rate, leading to adverse economic repercussions.

In a press statement, Sherif described the decisions as positive steps to stabilize the market, especially as the official dollar rate exceeded 50 pounds, completely eliminating the black market. Additionally, the decision to raise interest rates by 6% aims to restrain inflation, which poses a threat to the economy.

The Monetary Policy Committee decided in its extraordinary meeting to raise the deposit and lending rates for overnight operations and the main operation rate for the Central Bank by 600 basis points to 27.25%, 28.25%, and 27.75%, respectively. Similarly, the credit and discount rates were raised by 600 basis points to 27.75%.

The Egyptian Central Bank affirmed its commitment to maintaining price stability in the medium term. To achieve this, the bank continues its efforts to transition to a flexible inflation targeting framework, allowing the exchange rate to be determined by market mechanisms. It considers exchange rate unification a crucial step towards eliminating the accumulation of foreign currency demand following the closure of the gap between the official and parallel market rates.

The monetary policy decisions announced are part of a comprehensive economic reform package coordinated with the Egyptian government and supported by bilateral and multilateral partners.

Preparations for implementing the reform program include securing the necessary financing to support foreign currency liquidity.

The Central Bank emphasizes the importance of coordinating fiscal and monetary policies to mitigate the impact of external shocks on the local economy, ensuring overall economic stability and international reserves sustainability.

The elimination of the parallel foreign exchange market is expected to reduce inflation expectations and restrain inflation, leading to a downward trajectory in general inflation in the medium term. However, the Committee remains vigilant about geopolitical tensions, fluctuations in global commodity markets, and global financial conditions. Consequently, the Central Bank may clearly reconsider its targeted inflation rates based on economic developments.

Recognizing that the effects of the monetary policy decisions take time to transmit to the economy, the Committee will continue to assess the balance of risks surrounding inflation to control inflation expectations. It reiterates that the path of the basic interest rates depends on expected inflation rates.