Governor Hassan Abdalla: Central Bank Takes Decisive Action, Acknowledges Massive Dollar Supply Through Banking System

Egypt's Central Bank takes decisive measures to tackle inflation, raising interest rates by 6% and acknowledging a substantial supply of dollars through the banking system.

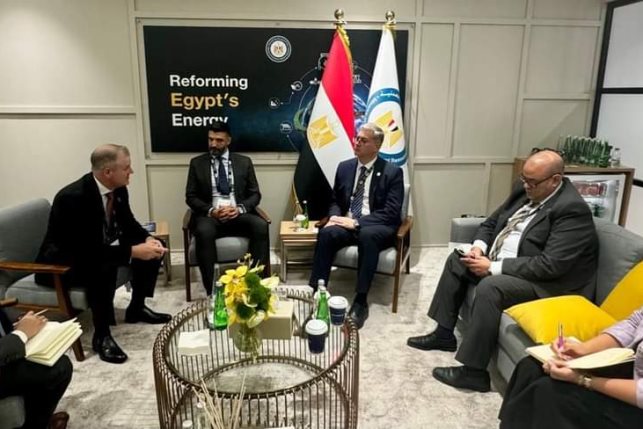

Egyptian Central Bank Governor, Hassan Abdalla during the press conference | Press Photo

Egyptian Central Bank Governor, Hassan Abdalla during the press conference | Press Photo

Egyptian Central Bank Governor, Hassan Abdalla, announced on Wednesday that the purpose of the 6% interest rate hike is to contain inflation and support citizens.

During a press conference, Abdalla stated that the state has an important program to reduce the level of inflation - the rise in prices of goods and services - which was targeted by today's interest rate hike to support citizens and direct foreign investment.

The Egyptian Central Bank reaffirmed its commitment to maintaining price stability in the medium term. To achieve this, the Central Bank is committed to continuing its efforts to transition towards a flexible framework for inflation targeting, by targeting inflation as a nominal anchor of monetary policy, while allowing the exchange rate to be determined according to market mechanisms.

Exchange rate unification is considered a critically important measure, as it contributes to eliminating the accumulation of demand for foreign currency following the closure of the gap between the official and parallel market exchange rates.

The Monetary Policy Committee, in its extraordinary meeting, decided to raise deposit and lending rates for overnight transactions and the main operation rate of the central bank by 600 basis points to reach 27.25%, 28.25%, and 27.75%, respectively. The credit and discount rates were also raised by 600 basis points to reach 27.75%.

Abdalla stated that significant quantities of dollars have been provided through the banking system and extended his gratitude to all banks and the central bank team for their efforts during the recent challenging period.