Dynamic Valuations: Charting Egypt's New Economic Course, Embracing Market Forces for Dynamic Exchange Rate Dynamics

Demand-driven exchange rates, determined by market forces, offer numerous benefits including increased efficiency, transparency, and resilience.

Allowing currencies to adjust based on supply and demand dynamics promote economic stability - File Photo

Allowing currencies to adjust based on supply and demand dynamics promote economic stability - File Photo

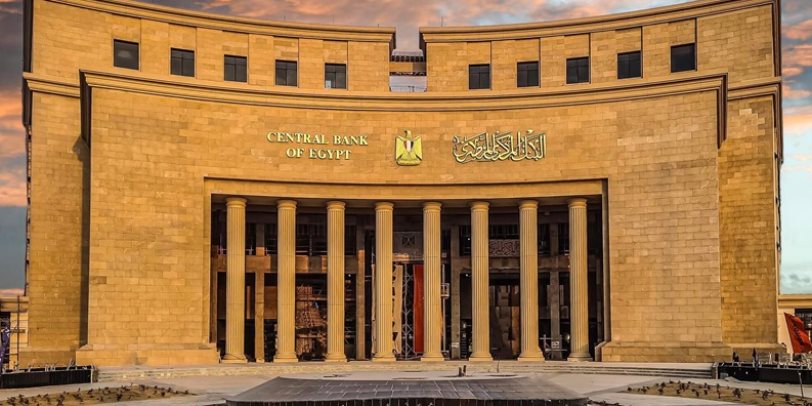

The Central Bank of Egypt has announced the allowance for the determination of the exchange rate of the pound according to market mechanisms.

The unification of the exchange rate is a critically important measure, as it contributes to eliminating the accumulation of demand for foreign currency following the closure of the gap between the official and parallel market exchange rates.

The exchange rate will be determined according to supply and demand mechanisms in banks, thus eliminating the parallel market for the dollar.

The local economy has recently been affected by a shortage of foreign currency resources, leading to the emergence of a parallel market for the exchange rate and a slowdown in economic growth.

External repercussions resulting from global inflationary pressures continued to accumulate concurrently with the global economy facing successive shocks.

These shocks and their repercussions have led to increased uncertainty and inflation expectations, further exacerbating inflationary pressures.

The exchange rate movements resulting from this, along with the rise in global prices of basic commodities alongside domestic supply shocks, have led to the continuity of inflationary pressures, pushing the general inflation rate to record levels.

Despite the recent slowdown in annual inflation rates, it is expected to exceed the target rate announced by the Central Bank of Egypt, which is 7% (± 2 percentage points) on average during the fourth quarter of 2024.

Embracing Market Dynamics: The Benefits of Demand-Driven Exchange Rates

In a world where economic landscapes are ever-evolving, the debate over exchange rate determination remains at the forefront of financial discourse. Advocates of market-driven exchange rates argue that allowing currencies to be valued based on demand fosters efficiency, transparency, and resilience within global financial systems. Here's why embracing demand-driven exchange rates is seen as a positive step forward.

First and foremost, market efficiency reigns supreme in a demand-driven exchange rate environment. By relinquishing control to market forces, exchange rates become a reflection of real-time economic conditions and investor sentiment. This fosters a dynamic pricing mechanism where currencies adjust swiftly to changing fundamentals, promoting more accurate valuations and reducing the likelihood of mispricing.

Moreover, the concept of price discovery thrives under a demand-driven exchange rate regime. With market participants constantly analyzing and reacting to economic data and geopolitical events, exchange rates become transparent and reliable indicators of a currency's true value. This transparency benefits businesses and investors engaged in international trade and investment, providing them with the confidence to make informed decisions.

The reduced need for intervention is another compelling argument in favor of demand-driven exchange rates. In allowing market forces to dictate currency valuations, policymakers are afforded greater flexibility and autonomy in managing their economies. This autonomy reduces the risk of currency manipulation and eliminates the need for constant central bank interventions, fostering a more stable and predictable trading environment.

Furthermore, the adaptability of demand-driven exchange rates cannot be overstated. In an increasingly interconnected global economy, the ability of currencies to adjust quickly to changing circumstances is paramount. Flexible exchange rates allow economies to absorb shocks more effectively, facilitating smoother adjustments and minimizing disruptions to trade and investment flows.

Lastly, demand-driven exchange rates serve as a catalyst for economic reforms and structural adjustments. Countries with flexible exchange rate regimes are incentivized to pursue sound economic policies that enhance competitiveness and attract foreign investment. The transparent and market-driven nature of exchange rates serves as a signal to policymakers, highlighting the need for reform and providing a framework for sustainable economic growth.

In conclusion, embracing demand-driven exchange rates offers a myriad of benefits for economies around the world. From promoting market efficiency and transparency to fostering resilience and incentivizing reforms, the advantages are clear. As the global economy continues to evolve, the case for market-driven exchange rates becomes increasingly compelling, paving the way for a more dynamic and resilient financial future.

Unleashing Economic Potential: The Advantages of Demand-Driven Exchange Rates

Amidst the ever-changing landscape of global finance, the debate surrounding exchange rate determination has taken center stage. At the heart of this discourse lies the proposition of embracing demand-driven exchange rates, a concept heralded by proponents for its potential to revolutionize the functioning of international monetary systems.

Advocates argue that relinquishing control to market forces not only fosters efficiency and transparency but also strengthens the resilience of economies in the face of volatility. As the world becomes increasingly interconnected, the merits of allowing currencies to be valued based on demand have come into sharper focus, prompting a reevaluation of traditional exchange rate regimes.

Enhanced Investment Climate: Demand-driven exchange rates create a more attractive investment climate by providing investors with a clear understanding of currency valuations. This transparency encourages both domestic and foreign investment, as investors can make well-informed decisions regarding asset allocation and capital deployment.

Boost to Export Competitiveness: A flexible exchange rate regime can bolster a country's export competitiveness by allowing its currency to adjust to changing market conditions. When a country's currency depreciates, its exports become more affordable to foreign buyers, stimulating demand for domestically produced goods and services and supporting economic growth.

Deterrence of Currency Speculation: Market-driven exchange rates discourage speculative activities that seek to exploit fixed or manipulated exchange rates for short-term gains. By allowing exchange rates to adjust freely based on supply and demand dynamics, speculative attacks are less likely to succeed, promoting stability in the foreign exchange market.

Alignment with Economic Fundamentals: Demand-driven exchange rates ensure that currency values align with underlying economic fundamentals, such as inflation rates, interest rates, and productivity levels. This alignment reduces the risk of currency misalignments and imbalances, fostering greater economic stability and reducing the likelihood of currency crises.

Facilitation of International Cooperation: Market-driven exchange rates promote cooperation and coordination among countries by providing a common framework for currency valuation. This facilitates smoother trade negotiations, financial cooperation, and policy coordination, leading to improved economic relations and greater global stability.

By incorporating these additional positive points, the argument for demand-driven exchange rates becomes even more robust, highlighting the multitude of benefits that accrue from allowing currencies to be valued based on market demand and supply dynamics.

In conclusion, the case for demand-driven exchange rates stands firm, fortified by a multitude of compelling advantages. From promoting market efficiency and transparency to bolstering resilience and fostering economic growth, the benefits are manifold.

As nations navigate the complexities of a rapidly evolving global economy, embracing market dynamics offers a pathway towards greater stability, prosperity, and cooperation. By allowing currencies to be valued based on the principles of supply and demand, policymakers can unleash the full potential of their economies, paving the way for a more dynamic and interconnected financial landscape.

As the world continues to evolve, the merits of demand-driven exchange rates serve as a beacon of progress, guiding economies towards a future defined by resilience, innovation, and prosperity.